Even al Ahram/Pravda is reporting that two recent attempts to raise small amounts of sovereign debt have failed because the market wanted more than 18% interest. (how long do you think Egypt can pay 18% on a minimum of $US100 billion external debt (maybe not all of it is at that rate but it has at least $US200 billion internal debt owed to the local banks and local investors).

Six days ago a third debt auction failed to attract interest. Reuters says this is part of a larger problem as capital retreats from risky markets and $US6 billion has been got out of Egyptian sovereign debt since March and the local stock market is a bit wobbly – possibly by foreigners wanting their cash out. https://www.reuters.com/article/egypt-t ... SL8N1W336B At the same time other than oil and gas few/no western companies want to invest in Egypt.

Looks like the signs, debt, stock market and direct investment are starting to look troublesome.

There is also huge domestic debt owed to citizens and local banks who loan to the government in such large amounts they have little for the private sector. Here is the minimum domestic sovereign debt:

The accumulated interest on domestic debt certificates puts the total at over E7 trillion. https://www.ceicdata.com/en/egypt/domes ... rtificates

This is odd because Moody’s in particular has been saying for 6 months that the debt was easy to sell (very oddly on the Dublin market) and that rates were going down. Credit rating movements have also been positive or not negative but I don’t trust Moody’s for the following reasons. They have no physical presence in Egypt but rely on data from dubious local alliances to draw its conclusions about Egypt including RiskMatrix in corrupt Cyprus and a joint venture in Egypt with a local company called Meris whose business is evaluating mainly property development floats, often the dirtiest like Palm Hills, its publications and activities since 2016 are zero, its chairman appears to be an engineer but that was found out through the back door because it is secret about its board and all its employees and customers. It says its listed on the stock exchange but I can’t find it. https://english.mubasher.info/countries ... ock-prices. Its website provides links to more information about the company but these are a dead end after years – wonder why. There is nothing on its site to show they have ever done any business outside Egypt or ever done ratings of any project that involved an international company of repute. If Moody’s relies on this company for Egypt information they are fools – that they have a joint venture with them is beyond belief. They have learnt little from their 2008 mistakes. https://merisratings.com/#page-1780.

The current debt sold over the past few years is on remarkably short maturity – sometimes 6 months. As I understand its repayment on maturing debt is through new debt. Therefore if they face chronic problems with new debt they are in real trouble and much/most/all of the reserves in the Central Bank are bull. They are not accumulated profits or trade balances – they are overwhelmingly debt and not an asset but a liability. There maybe some Saudi cash there and some hard currency from overseas remittances. No one is sure about how much of the reserves are dollars raised from debt sales – and therefore not really reserves.

http://english.ahram.org.eg/NewsContent ... sales.aspx

In addition the Egyptian International Cooperation Minister Sahar Nasr flew at short notice and borrowed (possibly at the last moment) $US3 billion from the International Islamic Trade Finance Corporation to pay for imported food and other shopping. This strikes me as bizarre and a sign that there is a fire inside the house. Borrowing capital to pay food bills – really. An ex-World Bank economist (not a very good one) she is breaking all the rules of economics and accounting 4 years into the ‘highly successful’ reform program.

A local expert said this about the debt situation:

“Increasing foreign debt and cautioned that future generations would bear the burden of it. According to Nahas, (an economic advisor to a number of financial institutions) a sustainable solution to Egypt's economic crisis requires the government to develop its own financial resources — that is, industrial, agricultural and tourist projects to generate income — rather than continuing to borrow money. He warned that the government could plunge into crises due to its reliance on short-term debt instruments, such as bonds, some of which the government has only three months to settle.”

Seems pretty obvious but I’m sure the world’s best bankers, the best Cabinet and the best Army know better.

Abdel Fattah Professor of Economics at Cairo U said, “The problem is that most of the debt is aimed at financing the budget deficit, importing basic commodities and increasing the country’s cash reserves in a bid to improve Egypt’s credit rating, but a part of the debt must be allocated to national industrial, agricultural or tourist projects in order to secure and develop financial resources, dispense with borrowing and contribute to the repayment of debt.” https://www.arabfinance.com/en/news/det ... ies/425044

Maybe they will fill the cash hole with a rushed sale of public assets to an international market that won’t touch them or their mad sale of their banks where the new owner has to pay a new tax and pay it to Sisi himself for his personal spending pot – the Mada Masr Fund (board includes at least 2 Mubarak era crooks).

It is possible that the recent problem is that the new debt is for much longer maturities, which the market is not prepared to trust Egypt with. https://www.zawya.com/mena/en/story/Egy ... N1VQ1BUX2/

As I have read it the insurance taken out by debt buyers on Egyptian debt default a year ago on short maturity debt was extremely high. This suggests that insurance on long maturity debt would be less than astronomical but in that region.

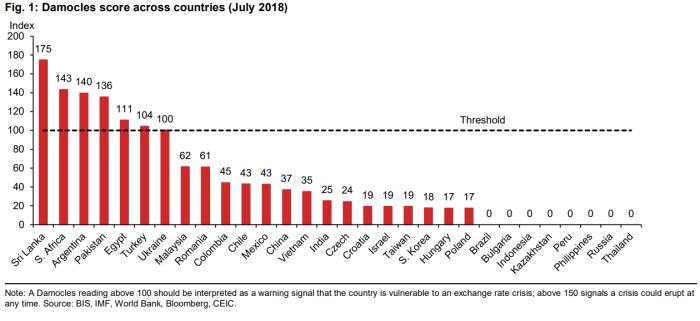

This time round the UAE might help but relations with Saudi are poor and that might affect the preparedness of others. Of course the Chinese can chip in on their principle that ‘once you borrow I own you’ – as Sri Lanka has found out and others are realizing – Pacific Island States, Pakistan and soon Ethiopia which is in over its head. Maybe its bestie – North Korea can help. From Sisi’s point of view he must realize that if he gets himself in a credit/cash flow problem the EU and maybe even the US might extract concessions from him. Russia can’t help.

Wonder where the Gulf $US30 billion that was paid into the Army bank account ended up. https://www.bbc.com/news/blogs-trending-31301903